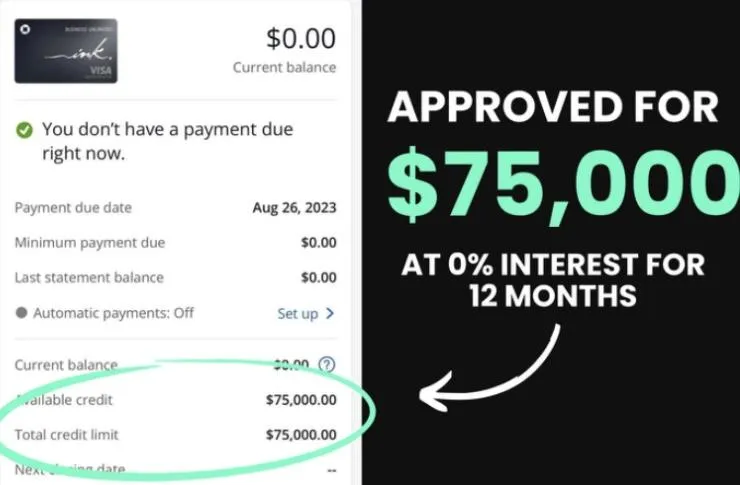

OWN A LLC AND HAVE A 700+ CREDIT SCORE

GET $50-250K+ IN 0% APR FUNDING IN 14 DAYS OR LESS

What is included in our services

We can help you secure $50,000 to $150,000 in business funding in the next 14 day without any upfront cost.

*No upfront cost

*0% Annual interest rate

*Pay After you get the funds

*Step by Step DONE FOR YOU

*We don't get paid until you're funded

We'll reach out to you to answer questions, guide you through the process and see it this would be a good fit for your business

Shop between multiple products to get the best deal

Term Loans

Term Loans provide a fixed amount that borrowers repay at a set rate, commonly used for business expansion, working capital, or equipment purchases. Benefits include traditional APR, no prepayment penalties, monthly payments, and rates starting at 7.99%, with funding in 1-3 days. Qualifications require 2 years in business, no bank liens or foreclosures in the past 3 years, and a 660+ FICO. Loan amounts range from $25K to $2M, with terms from 1 to 5 years.

Business Lines of Credit

A Business Line of Credit offers flexibility, allowing businesses to access funds as needed and pay interest only on the amount drawn. Funds become available again as the balance is paid down, with fast approvals. Qualifications include 6 months in business, $60K in annual sales, and no minimum FICO. Loan amounts range from $10K to $1M, with terms from 6 months to 10 years and funding in 1-3 days.

Equipment Financing

Equipment Financing allows businesses to acquire essential equipment without large upfront payments, preserving working capital. Available through leasing or loans, it is based on the equipment's value and the business's financial ability. Benefits include monthly payments, low or no down payment, and tax advantages (Section 179). Qualifications include no minimum time in business, a 580+ FICO score, and no required minimum annual revenue. Loan amounts range from $10K to $5M, with terms from 1 to 5 years and funding in 1 to 5 days.

Accounts Receivable Financing

Accounts Receivable Financing enables businesses to sell or use their outstanding invoices as collateral for working capital. It provides lower interest rates, doesn’t require additional collateral, and allows for factoring new receivables as they arise. Qualifications include no minimum FICO score, an aging report, and $500K+ in annual gross sales.

SBA Loan

SBA Loans are government-backed loans designed for starting or expanding a business, with eligibility requirements such as size standards, repayment ability, and a solid business purpose. Benefits include fixed and variable options, monthly payments, terms up to 25 years, prime rates, and government backing. Qualifications require $60K in gross annual sales, 3 years in business, no tax return losses in the last 2 years, and financials. Loan amounts go up to $5M, with terms up to 25 years and funding in 90-120 days.

Unsecured Working Capital

Unsecured Working Capital is a cash advance, repaid by withdrawing a percentage of daily credit sales. It’s customizable to business needs, with no compounding interest, and can be used for any purpose. Qualifications include 3 months in business, $60K in annual sales, and no minimum FICO. Loan amounts range from $10K to $5M, with flexible terms and same-day funding.

Over Hundreds of Entrepreneurs worldwide rely on Moore Legacy Consultants

Trusted solutions for funding, credit repair, and business growth to help you reach your goals.

Office: 17350 State Hwy 249 220 Houston Texas 77064

Call 877-454-4162

Email: